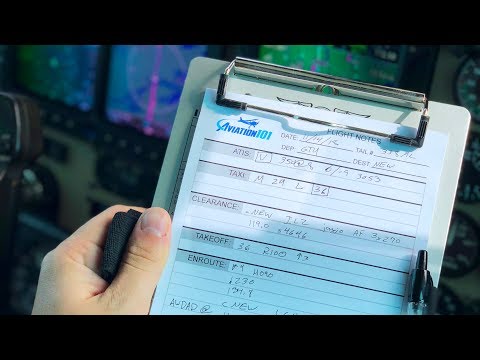

The poacher got a citation. Three to seven, I remember Mike departeth on with an executive. 1600 climbing 3000 edition. Three to seven, oh where where my got the departure ident often altimeter two Niner Niner four. Maintain all on zero thousand. Talking on the radio's and receiving air-traffic control instructions is one thing that is very difficult for a lot of people when they're learning to fly. That's why ever since I started to learn how to fly at Austin Bergstrom International Airport in those little Cessna 150 twos, I got in the habit of writing down air traffic control instructions. Well, line a modder precipitation extending from your 10 o'clock pier 1 o'clock. He'll be in it for about 8 flying mouth. Contact youth center workers. I maintain one 2,000. Contact youth center one three four point two. In this video, I'm gonna walk you through how I write down certain instructions, how I abbreviate things, and just kind of show you how I lay out my own shorthand that I've developed over the years. Visibility gonna have my rain 400-800 overcast. I would like to highlight that this is my way, it may not be your way. There are other ways to do this, this is just what works for me, how I write things down, how I remember them. I just added a new product to my eStore, and by the way, my e-store is live if you want to grab a hat or a shirt. I've got black and gray shirts, aviation101.com/store. I'll throw a card up here somewhere for it. This is one of the new products that I recently added to my eStore. This is a flight notes pad that goes on a kneeboard, made with good quality paper. There are 50 sheets on the pad,...

Award-winning PDF software

4952 Instructions Form: What You Should Know

Investment Interest Expense Deduction: Form 4952 — State—Topics How do I determine if I have investment interest expense expenses for the current tax year? Generally, it is better to figure your deduction for the year you incurred investment interest expenses. This year is the year in which an investment interest expense deduction may be allowable under tax law. Investment interest expense deductible for the current tax year is determined by the rules of Form 4952. This is a paper form that a taxpayer must complete and send to the IRS. The paper form contains basic information about your expenses and a return is mailed to the taxpayer with all information. There is no tax benefit in the IRS obtaining a paper tax return for a specific year. For further information, see: How do I figure what income I have in 2025 and future tax years? Income related to interest on capital assets is deductible. Capital assets include buildings, land, personal property, and cars, boats, trucks, trailers and motor vehicles. Capital gains income includes gains of capital property used in a trade or business. Taxable net investment income is the money left over after all of your investments — including interest, dividends and capital gains — have been deducted. See also: Alternative Minimum Tax: Capital Gains — Topic What are the requirements for a Form 4952? On form 4952, taxpayers must include any applicable interest expense. Generally, when completing the Form 4952 and filing it, a taxpayer must: 1. For a single taxpayer, include all interest expense incurred by the taxpayer in the preceding tax year that is related to qualifying rental property or qualifying rental and recreational activities during the taxable year. 2. For married, filing a joint return, include all interest expense incurred by the taxpayer in the preceding tax year for which he had to report in excess of the standard deduction. 3. Withhold interest expense from the tax until it is deductible. If, in a particular tax year, the interest expense exceeds the excess amount of the standard deduction, the interest expense is deductible at that time. If the interest expense exceeds the excess amount of the standard deduction, the interest expense is deductible in the following tax year. 4. Do not report dividends or capital gain realized from investing in real estate interests during the taxable year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4952, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4952 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4952 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4952 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 4952 Instructions